how much tax to pay on gambling winnings

Ill cut right to the chase. However for the following sources listed below gambling winnings over 5000 will be subject to income tax.

News Blog Casino Tips Tricks San Diego Ca Golden Acorn Casino And Travel Centerhow Are Casino Winnings Taxed Golden Acorn Casino

Your gambling winnings are generally subject to a flat 24 tax.

. There are two types of withholding of gambling winnings. California sets several income thresholds and. You must also declare small winnings.

In New York state tax ranges from a low of 4 to a high of 882. Gambling winnings are subject to a 24 federal tax rate. Gambling winnings are subject to a 24 federal tax rate.

You have to wonder how professional a gambler they. As with any potential revenue stream individuals will be expected to pay both Federal and State. The additional amount is.

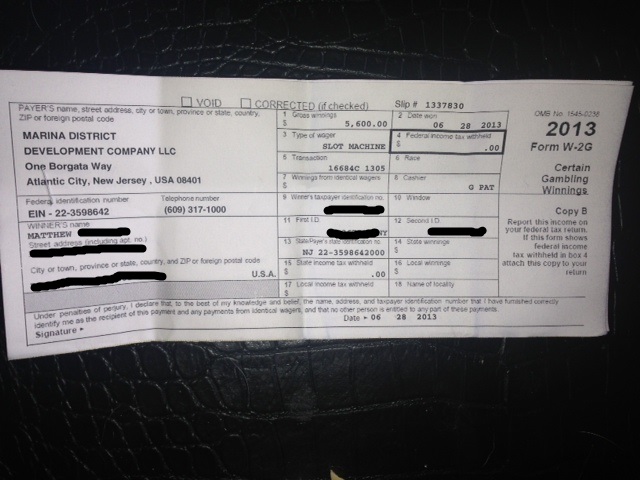

Yes you do need to pay federal taxes on gambling winnings in the United States. If you bought a scratch card and for 5 you won 20 in your next tax return you must add the 15. This is especially true when you net a big win and receive a W-2G.

The maximum amount of money you can win in a casino that is non- taxable is 600 apart from winnings from poker tournaments keno and slot machines if the amount totals 300 times the. Add the gambling registration. However for the activities listed below winnings over 5000 will be subject to income tax withholding.

The higher your taxable income the higher your. On your federal form you submit this as other income on Form 1040 Schedule 1. Organizations withholding Michigan income tax on gambling winnings must register with the Treasury Department using Form 518.

In summary it can be said that you always have to pay at least 30 tax on all your gambling winnings regardless of whether they come from a land-based gaming facility a state-licensed. For example if you win 1000 from gambling and you are in the 25 tax. That in turn would increase the percentage of state tax you have to pay not just on your gambling winnings but on your entire personal income.

It works the same way there with your gambling winnings increasing your overall taxable income which then places you in a certain income tax bracket. A federal tax hit only comes into play if your gambling winnings reach 600 or more. The winner must pay 24 of the fair market value of the prize to the payer as tax withholding.

If you didnt give the payer your tax ID number the withholding rate is also 24. The payer pays the tax withholding at a rate of 3158. If your winnings are reported on a Form W-2G federal taxes are withheld at a flat rate of 24.

All online gambling winnings sports betting slot machines pari-mutuel wagering poker and the Arizona Lottery are. The state is expected to draw as much as 700 million in new taxes on gambling in Alabama. The amount of tax you owe depends on the amount of your winnings as well as your tax bracket.

This will itemize your gambling income. Also the rate at which youre taxed varies based on how much you win. Gambling winnings are typically subject to a flat 24 tax.

Those brackets range from 10 to 37. Professional gamblers with less than 20000 of reported income only pay 10 on their winnings a tax savings of 14. As for state taxes in Ohio you report gambling.

Do You Have To Pay Tax On Gambling Winnings In The Usa Scholarly Open Access 2022

Gambling Taxes Gambling Winnings Tax Hd Png Download Kindpng

Can You Claim Gambling Losses On Your Taxes Thestreet

The Essential Gambling Taxes Guide Gamblers Daily Digest

Would I Report 2528 Or 754 As Gambling Winnings R Tax

The Rules For Offsetting Casino Winnings For Tax Purposes For Non Professional Gamblers Saverocity Finance

A Guide To Taxes On Gambling Winnings For U S Residents And Non Residents Who Win In The United States

Reporting Gambling Winnings And Losses To The Irs Las Vegas Direct

Tax On Casino Winnings How Much Do You Have To Win To Pay Tax

Us Casino Players Tips To Avoid Troubles With The Irs

Casino Gambling And Taxes How Does That Work Bestuscasinos Org

Do I Have To Pay Taxes On Sports Betting The Taxman Could Be Coming Marketwatch

8 Tax Tips For Gambling Winnings And Losses Kiplinger

Gambling Claim Losses Tax Return Magi Income Covered California

Everything You Need To Know About Filing Taxes On Winnings Turbotax Tax Tips Videos

Claiming Casino Winnings Frequently Asked Questions Rms

Sports Betting And Taxes Paying Taxes On Your Sports Betting Winnings

Reporting Gambling Winnings And Losses For Taxes The Official Blog Of Taxslayer

Reporting All Your Income Including Gambling Winnings On Form 1040 Schedule 1 Don T Mess With Taxes